Small Business Regulations

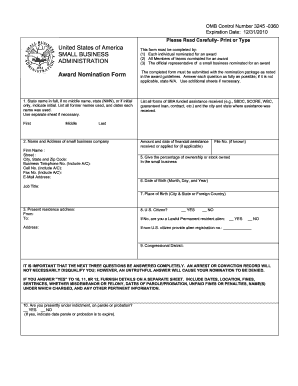

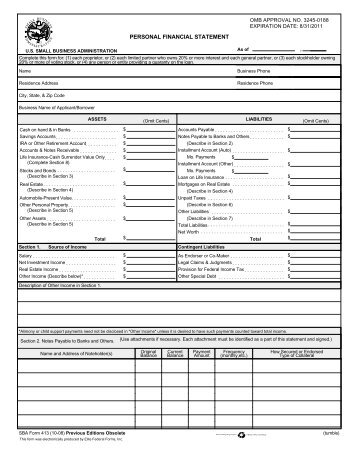

The Small Business Administration also referred to as SBA is put in place to help small enterprise house owners start or improve their companies by offering financial assistance. SBA loan will get more expensive, much bigger, needing a a lot higher quantity not only to make the loans but appointing employees and much more additional expenditures. The SBA plan starts with mentioning the mission of the enterprise giving a complete description of the growth of the organization, its targets and achievements together with the background of the organization.

A enterprise improvement plan can demand one or two months of graft and generally it is value whereas to acquire the assistance of a number of consultants who focus on growing enterprise proposals i.e. business growth consultants. The role of the SBA is to assist small business owners to begin and broaden their businesses by helping them get loans through non-public banks and monetary institutions.

We offer free, confidential, one-to-one business help and free or low-price instructional training applications to prospective and current small businesses throughout the Commonwealth. Different places of work embrace the Entrepreneurial Development, Congressional and Legislative Affairs, Subject Operation, Authorities Contracting and Business Development Hearings and Appeals.

The SBA …